Teaching Your Children About Debt: A Guide to Financial Education

Encrypting your link and protect the link from viruses, malware, thief, etc! Made your link safe to visit. Just Wait...

As parents, one of our most important responsibilities is to impart knowledge and life skills to our children. Among these, teaching them about managing finances is a crucial part of preparing them for the future. One essential aspect of financial literacy is understanding and managing debt. In this blog, we'll explore effective ways to teach your children about debt and instill responsible financial habits from an early age.

1. Start Early with Age-Appropriate Lessons

The key to teaching children about debt is to start early and adapt your approach to their age and understanding. Young children may not grasp complex financial concepts, but you can begin by teaching them the basics of money, such as saving and spending. Use simple language and examples they can relate to, like piggy banks and allowances. As they grow, gradually introduce more advanced concepts about debt, credit, and budgeting.

2. Be Open and Honest

Honesty is paramount when discussing financial matters with your children. Share your own experiences with debt, whether positive or negative, and explain how it has affected your life. Be transparent about your family's financial situation without burdening them with unnecessary stress. When they understand the real-world implications of debt, they are more likely to take your advice to heart.

3. Explain the Different Types of Debt

Teach your children about the various types of debt, including good debt and bad debt. Good debt, like a mortgage or student loans, can help them achieve long-term goals, such as homeownership or education. Bad debt, on the other hand, includes high-interest credit card debt that can be financially damaging. Explain the differences and the importance of making informed decisions when taking on debt.

4. Teach Budgeting Skills

Budgeting is a fundamental skill for managing finances and avoiding debt. Show your children how to create a budget, allocate money for different expenses, and prioritize savings. Encourage them to set financial goals and track their progress. You can involve them in family budgeting discussions to help them understand how the household finances work.

5. Use Real-Life Examples

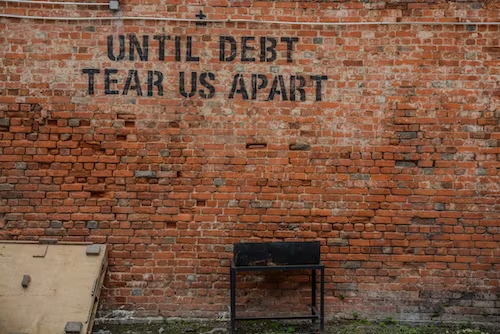

Use real-life examples to illustrate the consequences of debt. Share stories of friends or family members who have faced financial challenges due to excessive debt, or discuss news articles or documentaries about financial crises caused by poor money management. This can make the concept of debt more relatable and memorable for your children.

6. Encourage Saving

Teaching your children the importance of saving can help them avoid debt in the future. Encourage them to save a portion of their allowance or earnings, and consider matching their savings to show the value of long-term financial planning. You can open a savings account for them and discuss the concept of earning interest on their money.

7. Allow Them to Make Financial Decisions

As your children grow older, give them opportunities to make their own financial decisions within a controlled environment. Let them manage a portion of their money and experience the consequences of their choices. This hands-on experience can be a valuable lesson in financial responsibility.

Conclusion

Teaching your children about debt is an ongoing process that requires patience and consistency. By starting early, being open and honest, explaining the different types of debt, teaching budgeting skills, using real-life examples, encouraging saving, and allowing them to make financial decisions, you can equip your children with the knowledge and skills needed to make informed financial choices, avoid unnecessary debt, and set themselves up for a financially secure future. Remember that financial education is a lifelong journey, and your guidance can have a lasting impact on your children's financial well-being.